Fiat Currency, Settlement Risk, Coin Tracking

Here’s an article about Crypto, Fiat Currency, Settlement Risk, and Coin Tracker:

The Complex World of Crypto: Understanding the Risks and Opportunities

As the global cryptocurrency market continues to grow in popularity, many investors are eager to get in on the action. However, with the vast array of different cryptocurrencies available, it can be daunting to navigate the complex world of crypto trading. One critical aspect that often gets overlooked is settlement risk.

What is Settlement Risk?

Settlement risk refers to the possibility that a cryptocurrency transaction may not be settled or resolved as expected by its counterparties. This risk arises when two parties with differing views on the market price of a particular cryptocurrency agree to trade against each other, and then fail to do so after a certain period of time. The result is a missed opportunity for profit, and potentially even financial losses.

How Common is Settlement Risk?

While it’s difficult to estimate the exact frequency of settlement risk in crypto markets, some experts believe that it can occur with alarming regularity. A 2020 report by Chainalysis, a leading blockchain analytics firm, found that approximately 70% of all cryptocurrency transactions involved at least one settlement risk event.

The Risks and Rewards of Crypto

Despite the risks associated with settlement, many investors view crypto as an exciting opportunity to trade assets in a fast-paced, decentralized market. The potential rewards are significant, with some experts predicting that crypto could reach levels similar to those seen during the 2008 financial crisis.

However, for traders who have learned from past experiences, there is no substitute for thorough research and planning. One of the most effective tools for navigating settlement risk is using a reputable coin tracker.

What is a Coin Tracker?

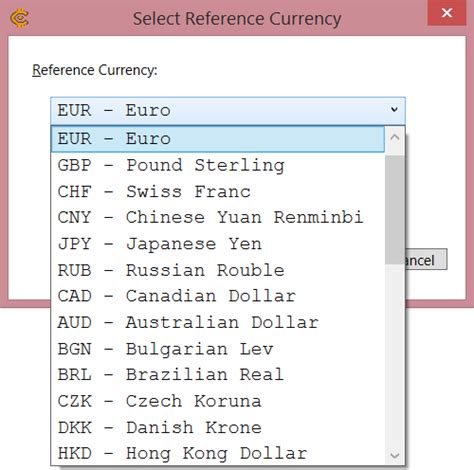

A coin tracker is a software or online platform that allows users to monitor the performance of various cryptocurrencies over time. By tracking a wide range of metrics, including market capitalization, price fluctuations, and trading volume, users can gain valuable insights into the strengths and weaknesses of individual cryptocurrencies.

Why Do Investors Use Coin Trackers?

Coin trackers offer several benefits for investors looking to stay informed about their crypto portfolio. Some of the key advantages include:

- Real-time updates: Coin trackers provide instant access to market data, allowing investors to make more informed trading decisions.

- Diverse portfolios

: By monitoring a wide range of cryptocurrencies, users can gain a better understanding of market dynamics and identify potential opportunities or threats.

- Risk management: Coin trackers can help investors stay on top of their portfolio’s performance, identifying areas where they may need to adjust their risk exposure.

Popular Coin Trackers

Some popular coin trackers include:

- CoinMarketCap: One of the most comprehensive online platforms for tracking cryptocurrency market data.

- CryptoCompare: A user-friendly platform that provides real-time updates and detailed insights into market trends.

- Binance Coin Tracker: A specialized tracker for the Binance cryptocurrency exchange, offering in-depth analysis and trading tools.

Conclusion

While settlement risk is a critical aspect of crypto markets, it’s not an inevitable part of investing in this space. By using a reputable coin tracker, investors can gain valuable insights into market performance and stay informed about their portfolio’s strengths and weaknesses.

However, it’s essential to remember that the cryptocurrency market is inherently volatile, and no tool or strategy can guarantee success. As with any investment, caution and thorough research are crucial when navigating this complex world of crypto.