KYC, trading volume, futures

The Future of Finance: A Guide to Cryptocurrency, Know Your Customer (KYC) Requirements, and Trading Volume in the Age of Digital Markets

In recent years, cryptocurrency has become a major player in the global financial market. With the potential for high returns on investment and decentralization from traditional institutions, cryptocurrencies have captured the attention of investors around the world. However, navigating the complex world of cryptocurrency trading involves much more than understanding the technology behind it: there are strict regulations and requirements that must be met to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) laws. .

What does Know Your Customer mean?

Know-Your-Customer, or KYC, is a process used by financial institutions to verify a person’s identity and confirm their legitimacy. The acronym stands for “Know”, “You”, “Client”. In the context of cryptocurrency trading, KYC is essential because it helps prevent illicit activities such as money laundering, terrorist financing and other forms of financial crime.

KYC Requirements in Cryptocurrency Trading

To comply with KYC regulations in cryptocurrency trading, investors are required to provide personal and identifying information when opening an account. This usually involves providing:

- Name and Identification

: Investors must provide their full name, date of birth and proof of identity (e.g. passport or national ID).

- Address: Provide a physical address or a digital wallet that can be used as a virtual address.

- Phone Number and Email: Verify a person’s contact information through phone calls or emails.

- Bank Account Details: Transferring funds to your cryptocurrency wallet is subject to KYC regulations, which require investors to provide bank account details.

Trading Volume: A Key Indicator of Market Activity

When it comes to measuring market activity, trading volume plays a significant role in determining whether an asset has gained or lost value. Trading volume refers to the total value of assets traded in a given period (e.g. day, week, month). High trading volume indicates that more people are buying or selling an asset, which can lead to increased price fluctuations.

Types of Cryptocurrency Trading

There are two main types of cryptocurrency trading:

- Spot Trading: Buying and selling cryptocurrencies at current market prices.

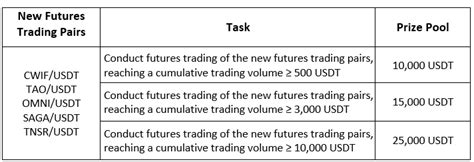

- Future Trading: Speculating on the future value of a cryptocurrency by locking in a fixed price for delivery within a specified time period.

Trading Volume in Futures Markets

In futures markets, trading volume refers to the total number of contracts traded in a given period (e.g., day, week, month). High trading volume indicates that more people are buying or selling contracts, which can lead to higher prices. Some notable trends in cryptocurrency futures trading include:

- Increased Adoption: As more institutional investors and hedge funds enter the market, trading volumes have increased significantly.

- Trend Analysis: Cryptocurrency price movements often follow trend lines (e.g., uptrend, downtrend), indicating that traders are buying or selling assets at certain times.

- Market Sentiment: Trading volumes can be influenced by market sentiment, with buyers and sellers showing different levels of enthusiasm for a particular asset.

Conclusion

In conclusion, cryptocurrency trading is a complex industry that requires adherence to strict regulations, such as KYC requirements, and high-volume trading indicators, such as futures markets. By understanding the importance of Know-Your-Customer processes and trend analysis in these markets, investors can make informed decisions about their investment strategies.